The efficient management of money requires the use of a feature-rich software tool that can help you track your expenses and savings. Now you can manage money in an efficient way using the Budget Software tool. With this tool, you can get frequent updates regarding your finances. Check out this article to find out some of the best Budget Software tools that are used by most of the people for easy tracking of money and budgets.

Read reviews, compare customer ratings, see screenshots, and learn more about Money - Budget & Finance. Download Money - Budget & Finance and enjoy it on your iPhone, iPad, iPod touch, or Mac OS X 10.12 or later.

- Download Visual Budget for Mac to easily manage your personal and business accounts.

- Mint QuickView is free budget software for Mac that ports the whole experience from the Web to your Mac desktop. With the app, you get alerts for all transactions and account changes, along with.

- Choose your awesome printable budget worksheet to start managing your personal finance today. Download free printable monthly budget spreadsheet you like, turn your printable budget sheets into printed worksheets and take full control over your cash flows. Two-pages monthly budget plan.

Related:

Home Budget Software

Home Budget Software serves as an excellent budgeting tool for the general purpose. This Budget Software tool comes with a well-organized, intuitive interface and it can be installed on all devices. It lets users edit/add transactions and view income & expenses in the form of graphs. Some of its features include transactions, categories, overview, tabs, total amount and savings.

Simple Home Budget

Good Budget

Home Budget Finance manager

Best Budget Software Mac

Budget Simple

Personal Budget Software

Personal Budget Software lets users gain total control of their money. This budgeting tool can be used for saving money, finding out your total expenses and paying off debts. It helps to smooth out the cash flow, let you stop overdrafts, reduces stress levels and helps to achieve financial peace.

Buxfer

MoneyWell

BudgetPulse

Pocketsmith

DaveRamsey Every Dollar

Movie Budget Software

Movie Budget Software tool helps to keep a detailed account of the budget for completing a whole movie. The details will be sorted out into various categories and so it makes life easier for a film production company. All the shots and scenes of the movie can be captured as per the schedule without suffering a loss.

Movie Magic Budgeting

Gorilla Budgeting

EasyBudget

Quick Film Budget

BoilerPlate Film TV Budgeting

Free Budget Downloads For Mac

Budget Software for Android

Budget Software for Android serves as the best money manager and expense tracker for all users. It can be considered as a pro-active budget planner which provides frequent updates on your bills, savings, and total expenditure. The application also provides an option for real-time tracking and gives you an estimated value of the total amount.

Mint

Mvelopes

Mobills

Free Personal Budget Software

Wally

The Budget Software tools help to manage money and budgets in a better way. You can formulate plans, keep track of every activity and manage your finances in an efficient manner. Download the best budgeting tool to get regular updates and track your finances so that you can keep a close eye on your expenditure.

Related Posts

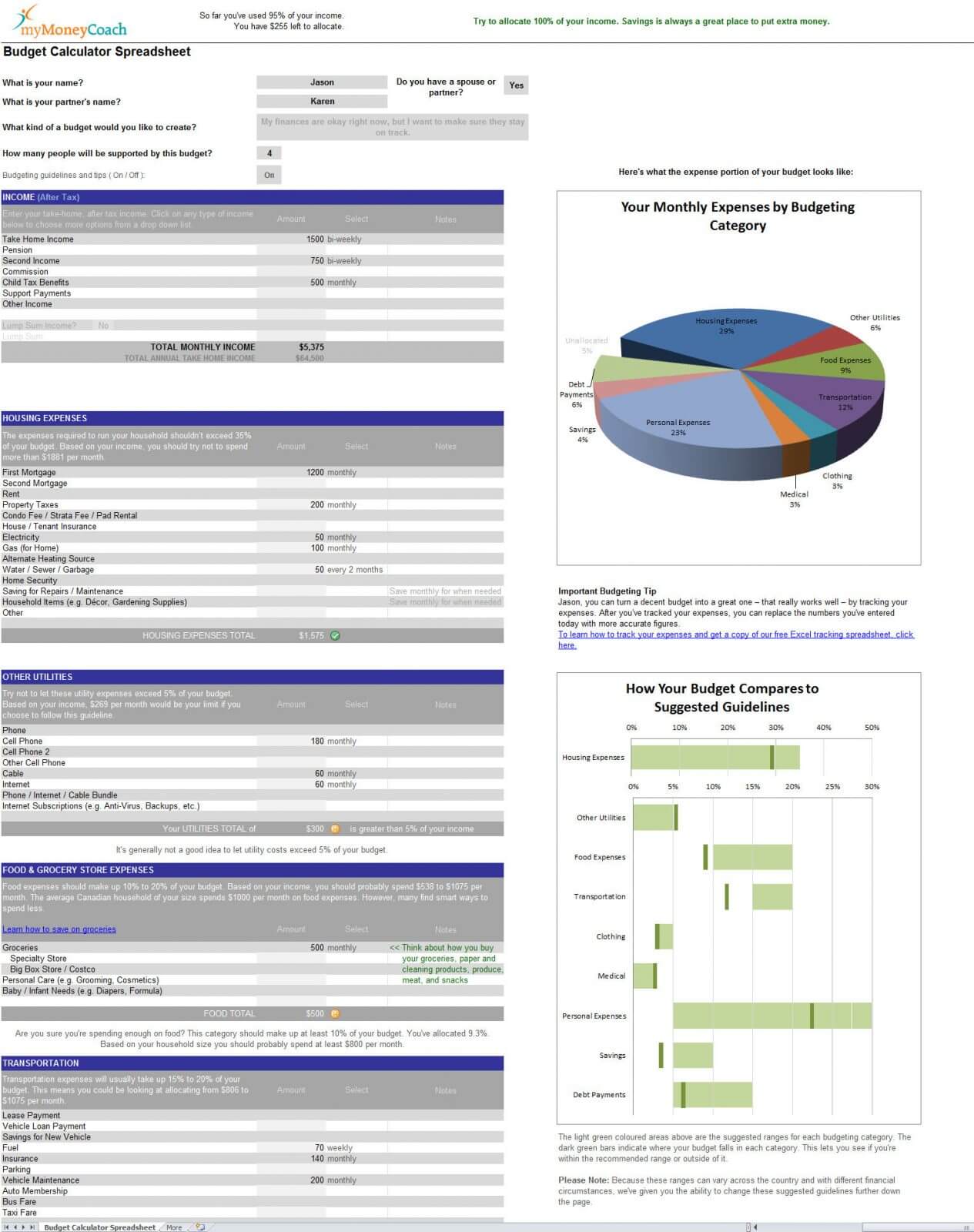

To make budgeting easier for you and your spouse, family or household, we’ve created an intelligent, interactive Canadian budget calculator spreadsheet in Excel that you can download and use for free as your personalbudgettemplate (it's now available on the Mac too).

Many people put off creating a household budget because they think that they don’t really know how to budget. Maybe you’re one of them. If you have doubts about how much to spend on certain expenses, aren’t sure if you did your budget right, or want help planning your monthly budget so that you can manage money better, this is the free Excel budget calculator spreadsheet to download now! (the Mac version works great too)

Features of Our Free Budget Worksheet and Calculator

| Download Microsoft Office Excel 2007 Worksheet (.xlsx) File | |

| Download Microsoft Office Excel 97-2003 Worksheet (.xls) File | |

If you don't have Microsoft Excel, you can download OpenOffice for free and then download the file below: | |

| Download Open Office Spreadsheet (.ods) File | |

You can also download the calculator spreadsheet on the Mac and open it in Numbers: | |

| Download Mac version as Numbers Spreadsheet (.numbers) File | |

Our free budgeting worksheet will help you manage your money better. The features of the calculator include:

- A calculator spreadsheet that is smart and interactive, to guide you through the budgeting process

- User-friendly, even if you don’t really know how to use Excel

- Simple, helpful graphs let you see your monthly spending in a whole new way (just in case you're not a numbers person)

- Provides guidelines for how much to spend in each category of your budget. This allows you to compare your spending to what's 'normal'

- Clear graphs, dollar values and percentages so that you can adjust things as you go

- Stand-alone Excel or Open Office file keeps your information private on your own computer

- It does all the math for you

- Drop down menus let you tell it whether each expense occurs weekly, monthly, annually, etc.

- Keeps a running tally of how much you’re planning to spend versus your income

- Identifies common budgeting pitfalls and offers tips and solutions to fix them

- If you want to reduce your expenses, it can suggest dozens of places where you could consider reducing your expenses to save money

- Easy to use with more personalized expense categories than other similar templates

What Does a Normal Personal or Household Budget Look Like?

Budgeting and money management guidelines for after-tax income and to avoid debt

There’s no such thing as a “normal” budget, but based on tens of thousands of credit counselling appointments, we’ve been able to create Canadian guidelines for how people will generally want to spend their after-tax income to avoid getting into debt.

Everyone allocates their money for personal or household expenses and savings a bit differently. This free spreadsheet includes our very popular budgeting guidelines so that you have an idea about how your spending compares to that of other Canadians with similar sized households.

Use the Savings Calculator to Plan for Annual, Emergency and Unexpected Expenses to Avoid Debt

A savings calculator is built right into the worksheet so that it’s easy to see the amount of money you need to set aside for annual, emergency and unexpected expenses. Expenses that you don’t expect, or which don’t occur on a monthly basis, can cause you to reach for a credit card. Then it can feel like your spending plan is off track as you try to get out of debt.

Using the budget calculator spreadsheet will help you identify the different types of expenses that you need to plan for and what to save for each. It will also help you learn where to trim your spending so that you have the money to set aside in savings for short term goals and long term plans.

Free Online Budgeting Apps & Tools – Track Your Expenses to Make Money Management Easier

If you’ve searched for free online budgeting apps and tools, you’ve likely discovered that there are some great tools available to help you plan your spending and track your expenses. However, if you are worried about divulging too much information about your spending, or are hesitant to allow an app read-only access to see your bank account transactions, you are not alone.

Depending on your financial institution’s debit card holder agreement and electronic banking terms and conditions, you may be in violation of your agreement if you disclose your passwords and PINs to a third party. Using our spreadsheet will not put you in violation of your banking agreements.

Excel Personal Budget Template Is Secure

Our free Excel personal budget template is as secure as you make it. It’s up to you to download it, use it on your laptop, PC or Mac, and save it securely. You do not need special permissions to use the spreadsheet nor do you need to allow it any access to your bank account. It is easy to use even if you don’t really know how to use Excel.

This Budgeting Assistant is Probably the Next Best Thing to Sitting Down with a Real Expert

While nothing beats sitting down one-on-one with a budgeting expert to craft your budget, this budgeting assistant is the next best thing. As you fill out your budget, it will alert you to anything it thinks is off and then offer suggestions to help you build a solid budget. In addition to helping you throughout the process of creating your budget, when you're finished, it can look for dozens of opportunities to help you further improve your budget and save money.

Screenshot of a Sample Budget on the Budget Calculator

Click on the image below to see a larger view.

Free Excel Budget Calculator Spreadsheet for Canadians – Personal Help to Create a Budget and Deal with Debt

As you fill in the free Excel budget calculator spreadsheet, tips will alert you to areas of your spending plan that may be cause for concern. If you would like personal help from a qualified, professional Credit Counsellor to balance your budget and deal with debt, contact a non-profit credit counselling organization in your area today.

Additional budgeting resources: